How To Create a Budget You Can Stick To in 5 Steps

Inflation has affected all of us. And now with student loan payments set to start up again this fall, the financial strain might feel overwhelming.

But NOT paying student loan payments can make everything much worse.

One way to address this or any additional expenses is to sit down and create a budget. Let’s take a look at how to create a budget plan step by step.

Step One: Write Down All of Your Spending

Step one is probably the hardest and scariest part, so let’s get it over with. Make time, either for yourself or with your partner, to list all of your expenses, including:

- All housing-related bills — rent, electricity, water, internet, cable, cell phones.

- All other bills — car payments, credit cards, personal loans, other installment payments, student loan paperwork, streaming services — ANYTHING you pay on a monthly basis.

- Other monthly expenses — write down other monthly expenses like groceries, eating out, salon expenses — anything you spend money on regularly.

- Non-monthly expenses — think about medical expenses that pop up, unexpected car repairs, or gifts for birthdays and other special occasions that happen throughout the year. To figure out the average monthly amount, add up your yearly total for these expenses and divide by twelve.

Yes, this can seem like a LOT. But that’s the point. You need to face your bills and expenses head-on. The good news is, after the process, there are usually ways to cut expenses and find some extra room in the budget.

But what if you really don’t know what you’re spending extra on each month? Track your spending. This might be a little more time-consuming to track if you use cash for your purchases, but if you use a debit or credit card, you can review your statements or transaction history online – or use a budget app to help with this task.

Step Two: Get Out the Calculator

Now that you’ve reviewed and written down all the things you spend money on, it’s time to add up the monthly amounts, but first, you will want to figure out your monthly income.

Here is a quick reference guide to calculating your monthly income based on how often you are paid (Note: Always use your NET pay, not your gross pay):

- Weekly pay: Multiply your pay by 52 and then divide that number by 12.

- Biweekly pay: Multiply your pay by 26 and then divide that number by 12.

- Semi-monthly pay: Multiply your pay by 2.

That’s it! Time for step three.

Step Three: Evaluate Your Options

So you’ve done the math, which means you have your total monthly expenses and your total monthly income and are in one of three situations:

- You have money left over every month.

- You are able to pay your expenses but have nothing left over.

- You are spending more than you are making, using credit cards or borrowing money to get by.

Let’s examine the first scenario. You have money left over. Is it enough? Are you factoring in student loan payments or upcoming expenses you are trying to plan for? If it is enough, then great! If not, circle back to your list of expenses and think about which items you can live without. These are highly individualized decisions. If cutting something out of your budget completely is going to make you miserable, maybe you can cut back on that item instead of eliminating it altogether.

Most experts will recommend you pay yourself first by putting money aside for savings, but when our budgets get crunched, savings can be one of the first things to go. If you are fortunate enough to have money left over each month, no matter how much, budget that money to savings.

If you are in scenarios 2 and 3, where you are struggling to pay everything or have very little left over, it’s time to take a hard look at your expenses. Is there anything you can reduce or eliminate altogether? Do you really need six streaming services? Can you reduce the number of times you eat out each week and cook at home instead? Or go to the salon every other month and not monthly?

Step Four: Save More

No matter what situation you are in, saving more should always be a goal. During tough times, dipping into a savings account can save us from using credit cards, or worse.

Consider some of the following tips to help you save:

- Take a list to the grocery store and only buy what you need. Try to plan meals ahead of time so you make multiple meals out of only a few ingredients.

- Buy gently used clothing or toys for your children at thrift stores or online through thredUP, Poshmark, or Mercari.

- Try to save on energy costs by going on a budget plan with your provider, or turning your thermostat down 5 degrees in the winter, and up 5 degrees in the summer if your unit has central air. Turn off lights when no one is in the room, and run appliances like washing machines or dishwashers only when full, and use cold water instead of hot.

- Talk to creditors or medical billing offices to go on a payment plan, especially if you’ve fallen behind on payments. Some creditors will also negotiate a smaller balance if you pay the remainder of the bill in full.

If your expenses are what they are, then it might be time to earn more income. Whether you need to find a better paying job, ask for more hours, a raise, or take on a second job, increasing your income might be the only solution.

Now that we have you thinking about trimming your expenses down, whether short-term or long-term, let’s look at the next step, where making a plan that you can stick to will help lead you to success.

Step Five: Make a Plan You Can Live With

Now that you know the reality of your financial situation, you may actually feel relieved to have it all out in the open. Many times we hide from our finances, just hoping the situation will get better.

But you can create a plan to make it better. Here’s how:

- Don’t set yourself up to fail. Don’t eliminate an expense you know you or your family can’t live without.

- Set up automatic payments to your savings account each time you are paid. Whether it’s $5 or $50, it WILL add up over time. Try not to touch this account unless it’s an emergency.

- Think weekly. Maybe you have a big bill, like your rent, that is tough to pay when it’s due. For instance, if your rent is $1,200, put $300 away each week so it is easier to pay that $1,200 when it’s due.

- Hold yourself accountable. If you create a budget but don’t share it with your partner or family, it will be that much harder to stick to. Make sure everyone is on board. After all, your children may come up with thrifty ways to save that you hadn’t even thought about!

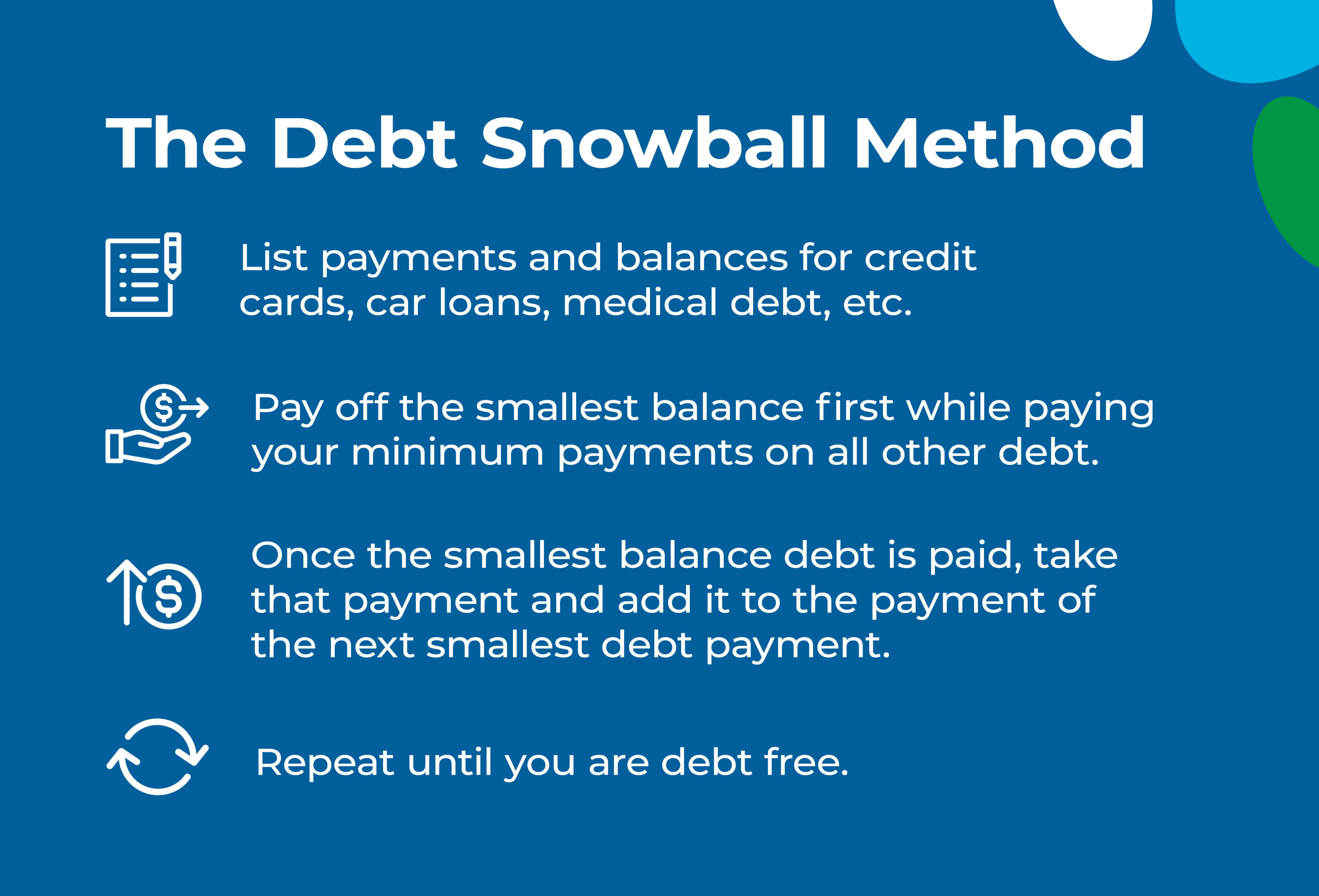

Remember, a budget is not a one-time project. It should be ongoing. After all, our income and expenses change. Make sure you check back in with your budget, especially after you pay off an installment plan or loan — have a plan to save that extra money, or use it to pay off another debt using the debt snowball strategy.

If you feel overwhelmed and need extra help with your budget, reach out to a local organization that can help with budgeting, debt management, or credit counseling. And if your student loans are set to resume in October 2023, reach out to your servicers to request an income-based repayment plan to help ease yourself into the payment.

Taking the time to write down your monthly spending will help you see ways to cut back or save that you weren’t aware of before. No matter what, remember to be positive, be realistic, and don’t give up! You will find a way to get where you want to be.

About Stone Ridge Residences

Stone Ridge Residences, formerly known as the Herkimer Housing Authority, was established on April 11, 1951 to offer safe, decent, affordable housing to low-income families, disabled individuals, veterans, and senior citizens in the Village of Herkimer.